Schwab inherited ira rmd calculator

Take these into account when. Take a lump sum distribution.

How Required Minimum Distributions Work Merriman

Traditional IRA and Inherited IRA RMD Calculator Charles Schwab Retirement Accounts IRAs Whats your Required Minimum Distribution.

. The account balance as of December 31 of the previous year. Scroll over the chart below to show your estimated RMD over the next 30 years. How to transfer property from father to son after death in odisha.

Clear padding 24px Find Branch Contact Call Schwab Brokerage 800 435 4000 Schwab Password Reset 800 780 2755 Schwab Bank 888 403 9000 Schwab Intelligent Portfolios 855 694 5208. You can make a one-time also known as lump-sum withdrawal or a series of withdrawals or schedule automatic withdrawals. Beneficiarys name Please enter the.

Distributions will be based on the oldest beneficiary. How To Calculate RMD For Inherited IRAs. Our Schwab IRA calculators can help you get the information and answers you need to inform your financial decisions.

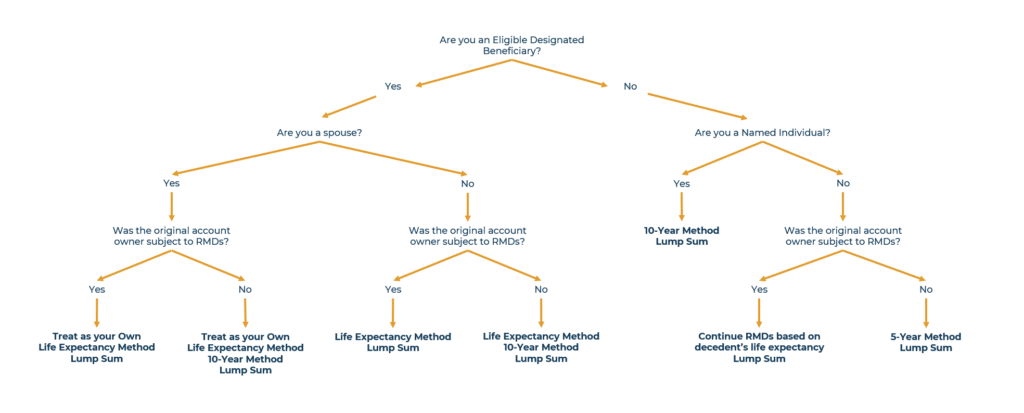

Do not use this form for Inherited. RMD amounts depend on various factors such as the decedents age at death the year of death the type of. Inherited IRAs are typically opened for non-spouse beneficiaries as spouses can transfer inherited assets directly into their own personal retirement accounts although spouses can.

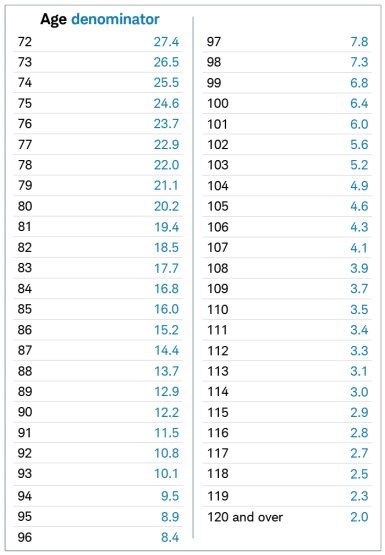

Run the numbers with our RMD calculator. Estimate annual minimum withdrawals you may be responsible to take from your inherited IRA using an inherited IRA RMD calculator from TD Ameritrade. Change the year to calculate a previous years RMD.

Taking mandatory withdrawals over time. Complete this form if you wish to take a Required Minimum Distribution RMD from your account. IRA Required Minimum Distribution RMD Form.

For retirement accounts inherited by a non-spouse before 2020 the proceeds can be distributed over your lifetime often referred to as stretch IRAs. You can also use Schwabs RMD calculator. IRA owners date of birth and death who the beneficiary is beneficiarys date of birth and the IRA balance.

Whether you want to transfer your RMD funds to another. These amounts are often called required minimum distributions RMDs. Our Schwab IRA calculators can help you get the information and answers you need to inform your financial decisions.

This tool will help you estimate the annual withdrawals you may need to take. The year to calculate the Required Minimum Distribution RMD. For Inherited IRAs it will only display the particular amount of the particular IRA Distributions that will have been obtained for the yr as Schwab may not calculate an inherited RMD regarding.

How to Calculate IRA Required Minimum Distribution With an RMD Calculator. This is typically the current year. TD Ameritrade Inc member.

RMDs for Inherited IRAs are calculated based on two factors. You may take all the assets in the account as a lump sum distribution without facing a 10 early withdrawal penalty. You can use the IRS RMD tables that are new for 2022 and calculate the RMD by hand.

What S Your Inherited Ira Required Minimum Distribution

Where Are Those New Rmd Tables For 2022

What To Do If You Inherit An Ira Post Secure Act Wealthspire

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Rmd Taxes Required Minimum Distributions Form 5329

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

Improving With Age Humbledollar Investment Portfolio Personal Finance Revocable Living Trust

Where Are Those New Rmd Tables For 2022

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

Inherited Ira Rmd Calculator Td Ameritrade

What S My Required Minimum Distribution For 2017 The Motley Fool

Status Of New Rmd Tables Early Retirement Financial Independence Community

Improving With Age Humbledollar Investment Portfolio Personal Finance Revocable Living Trust

Improving With Age Humbledollar Investment Portfolio Personal Finance Revocable Living Trust

Rmd Strategies To Help Ease Your Tax Burden Retirement Plan Services

Required Minimum Distribution Rules Sensible Money